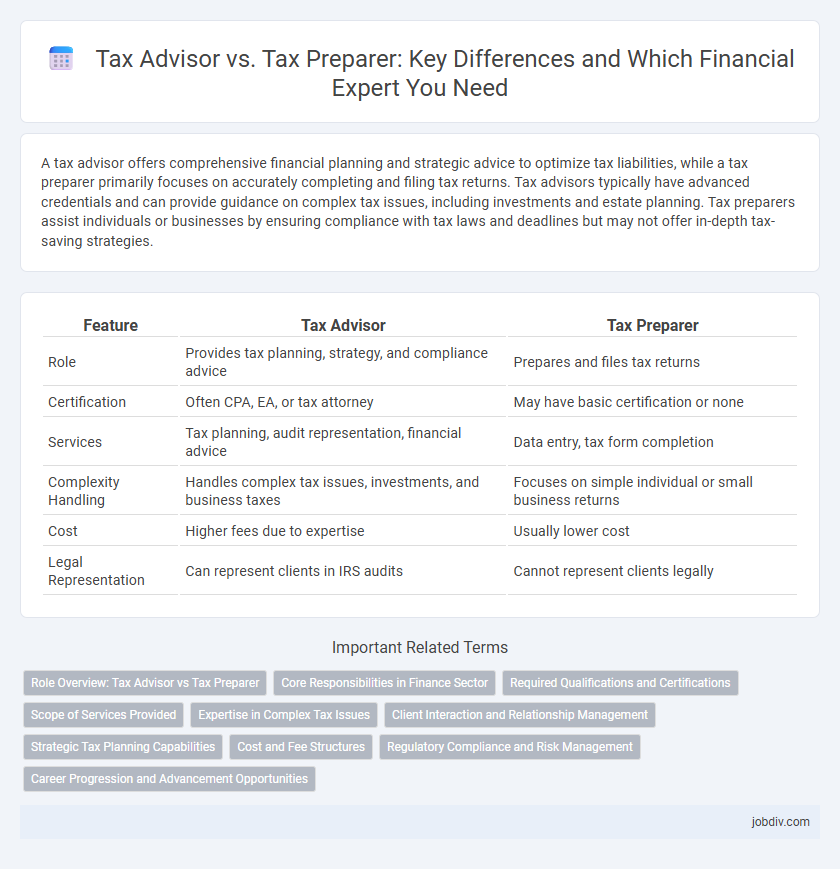

A tax advisor offers comprehensive financial planning and strategic advice to optimize tax liabilities, while a tax preparer primarily focuses on accurately completing and filing tax returns. Tax advisors typically have advanced credentials and can provide guidance on complex tax issues, including investments and estate planning. Tax preparers assist individuals or businesses by ensuring compliance with tax laws and deadlines but may not offer in-depth tax-saving strategies.

Table of Comparison

| Feature | Tax Advisor | Tax Preparer |

|---|---|---|

| Role | Provides tax planning, strategy, and compliance advice | Prepares and files tax returns |

| Certification | Often CPA, EA, or tax attorney | May have basic certification or none |

| Services | Tax planning, audit representation, financial advice | Data entry, tax form completion |

| Complexity Handling | Handles complex tax issues, investments, and business taxes | Focuses on simple individual or small business returns |

| Cost | Higher fees due to expertise | Usually lower cost |

| Legal Representation | Can represent clients in IRS audits | Cannot represent clients legally |

Role Overview: Tax Advisor vs Tax Preparer

Tax advisors offer strategic planning and comprehensive guidance on tax regulations, helping individuals and businesses optimize tax liabilities and ensure compliance. Tax preparers primarily focus on accurately completing and filing tax returns based on client-provided financial information. While tax advisors provide proactive, tailored advice for tax strategy, tax preparers deliver essential support in managing and submitting tax documents efficiently.

Core Responsibilities in Finance Sector

Tax advisors provide strategic financial planning, ensuring compliance with complex tax laws and regulations while optimizing tax liabilities for individuals and businesses. Tax preparers focus on accurately completing and filing tax returns, verifying financial documents, and meeting statutory deadlines to avoid penalties. Both roles require thorough knowledge of tax codes, but advisors emphasize consultancy and long-term planning, whereas preparers concentrate on detailed data entry and regulatory adherence.

Required Qualifications and Certifications

Tax advisors typically require advanced qualifications such as a Certified Public Accountant (CPA) license or a Chartered Tax Adviser (CTA) certification, demonstrating extensive knowledge in tax planning and strategy. Tax preparers often need a Preparer Tax Identification Number (PTIN) issued by the IRS and may hold certifications like the IRS Annual Filing Season Program (AFSP) to prepare tax returns accurately. The depth of expertise and complexity of tax issues handled by tax advisors generally surpass that of tax preparers due to their formal education and professional credentials.

Scope of Services Provided

Tax advisors offer comprehensive financial planning, strategic tax minimization, and in-depth analysis of complex tax regulations, whereas tax preparers primarily focus on the accurate completion and filing of tax returns. Tax advisors provide ongoing consultation, audit representation, and customized advice tailored to individual or business tax situations. The broader scope of services from tax advisors includes tax strategy development and proactive planning to optimize tax liabilities, beyond the transactional tasks handled by tax preparers.

Expertise in Complex Tax Issues

Tax advisors possess advanced expertise in complex tax issues, including estate planning, international tax law, and corporate tax strategy, enabling them to provide comprehensive guidance tailored to intricate financial situations. In contrast, tax preparers typically focus on accurately completing standard tax returns and may lack the specialized knowledge required to address multifaceted tax challenges. Clients with complicated tax matters benefit from consulting tax advisors who stay updated on evolving tax codes and offer strategic planning beyond basic return preparation.

Client Interaction and Relationship Management

Tax advisors engage in comprehensive client interaction, offering personalized tax planning and strategic advice tailored to individual financial goals, which fosters long-term relationships built on trust and expertise. Tax preparers primarily focus on accurately completing tax returns and ensuring compliance, resulting in more transactional, short-term interactions with clients. Effective relationship management by tax advisors often leads to ongoing support and proactive financial guidance, distinguishing their service from the more procedural role of tax preparers.

Strategic Tax Planning Capabilities

Tax advisors provide comprehensive strategic tax planning capabilities by analyzing financial situations to minimize tax liabilities and optimize long-term financial outcomes, while tax preparers primarily focus on accurately filing tax returns based on existing financial data. Advanced tax advisors leverage expertise in tax codes, investment strategies, and business structuring to develop personalized tax strategies that align with clients' financial goals. Tax preparers typically lack the in-depth strategic planning skills required to advise on complex tax-saving opportunities or future tax implications.

Cost and Fee Structures

Tax advisors typically charge higher fees due to their advanced expertise and comprehensive services, often billing hourly or through project-based pricing. Tax preparers usually offer lower, flat-rate fees for straightforward tax filing, making them cost-effective for simple returns. Clients should evaluate the complexity of their tax situation to determine whether the investment in a tax advisor's in-depth guidance justifies the higher cost compared to the more budget-friendly tax preparer.

Regulatory Compliance and Risk Management

Tax advisors provide comprehensive regulatory compliance guidance and develop tailored risk management strategies to minimize tax liabilities and avoid penalties. Tax preparers primarily focus on accurately completing and filing tax returns according to current tax laws and forms, with limited scope in strategic risk assessment. Both roles require up-to-date knowledge of tax codes, but tax advisors engage deeply in compliance audits and long-term planning to mitigate financial risks.

Career Progression and Advancement Opportunities

Tax advisors often have advanced certifications such as CPA or Enrolled Agent, enabling higher-level career progression into roles like tax consulting, financial planning, and corporate tax management. Tax preparers typically start with basic tax filing skills and can advance to senior preparer or office manager positions, but may require additional education to transition into advisory roles. Career advancement for tax advisors generally involves continuous professional development and specialization, offering broader opportunities for leadership and strategic financial roles.

Tax Advisor vs Tax Preparer Infographic

jobdiv.com

jobdiv.com