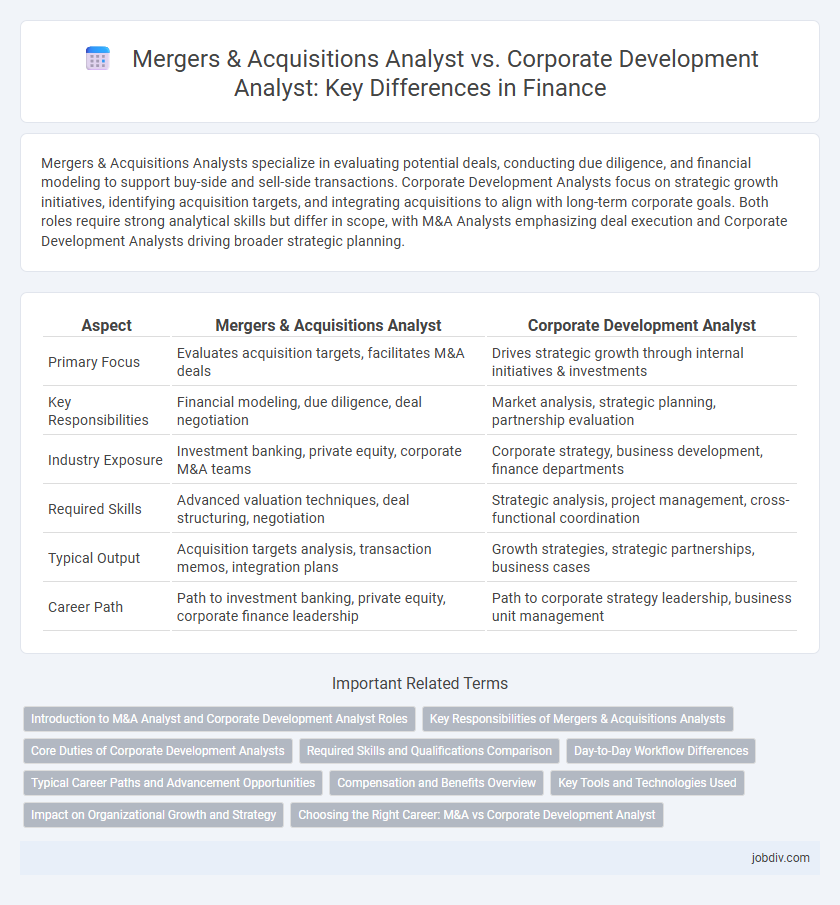

Mergers & Acquisitions Analysts specialize in evaluating potential deals, conducting due diligence, and financial modeling to support buy-side and sell-side transactions. Corporate Development Analysts focus on strategic growth initiatives, identifying acquisition targets, and integrating acquisitions to align with long-term corporate goals. Both roles require strong analytical skills but differ in scope, with M&A Analysts emphasizing deal execution and Corporate Development Analysts driving broader strategic planning.

Table of Comparison

| Aspect | Mergers & Acquisitions Analyst | Corporate Development Analyst |

|---|---|---|

| Primary Focus | Evaluates acquisition targets, facilitates M&A deals | Drives strategic growth through internal initiatives & investments |

| Key Responsibilities | Financial modeling, due diligence, deal negotiation | Market analysis, strategic planning, partnership evaluation |

| Industry Exposure | Investment banking, private equity, corporate M&A teams | Corporate strategy, business development, finance departments |

| Required Skills | Advanced valuation techniques, deal structuring, negotiation | Strategic analysis, project management, cross-functional coordination |

| Typical Output | Acquisition targets analysis, transaction memos, integration plans | Growth strategies, strategic partnerships, business cases |

| Career Path | Path to investment banking, private equity, corporate finance leadership | Path to corporate strategy leadership, business unit management |

Introduction to M&A Analyst and Corporate Development Analyst Roles

Mergers & Acquisitions Analysts specialize in evaluating potential acquisition targets, conducting due diligence, and modeling financial scenarios to support deal execution. Corporate Development Analysts focus on strategic growth initiatives, including mergers, acquisitions, divestitures, and partnerships, aligning transactions with long-term corporate goals. Both roles require strong financial analysis skills, but M&A Analysts concentrate on deal-specific processes while Corporate Development Analysts manage broader strategic planning and integration efforts.

Key Responsibilities of Mergers & Acquisitions Analysts

Mergers & Acquisitions Analysts primarily focus on conducting extensive financial modeling, valuation analysis, and due diligence to assess potential acquisition targets and merger opportunities. They prepare detailed transaction documents, support deal negotiations, and monitor market trends to identify strategic fit and value creation potential. Their role requires deep analytical skills and collaboration with investment bankers, legal teams, and senior executives to drive successful deal execution.

Core Duties of Corporate Development Analysts

Corporate Development Analysts primarily focus on strategic growth initiatives by evaluating potential mergers, acquisitions, and partnerships to enhance company value. They conduct financial modeling, due diligence, and market analysis to support decision-making and integration planning. Their role emphasizes collaboration with senior management to align acquisitions with long-term corporate objectives and ensure seamless post-merger integration.

Required Skills and Qualifications Comparison

Mergers & Acquisitions Analysts typically require advanced financial modeling skills, proficiency in valuation techniques such as DCF and comparable company analysis, and expertise in due diligence processes. Corporate Development Analysts must demonstrate strong strategic thinking abilities, experience with internal business analysis, and capabilities in project management alongside financial acumen. Both roles demand exceptional communication skills, attention to detail, and a solid understanding of market dynamics and industry trends.

Day-to-Day Workflow Differences

Mergers & Acquisitions Analysts primarily conduct detailed financial modeling, target company valuation, and due diligence to support transaction execution. Corporate Development Analysts focus on strategic initiatives, internal growth projects, and post-merger integration, aligning acquisition opportunities with long-term business goals. Both roles require collaborative work with cross-functional teams, but M&A Analysts emphasize deal-centric tasks while Corporate Development Analysts concentrate on broader corporate strategy and operational impact.

Typical Career Paths and Advancement Opportunities

Mergers & Acquisitions Analysts typically advance toward roles such as Associate or Vice President at investment banks, private equity firms, or consulting companies, leveraging deal execution experience and financial modeling skills. Corporate Development Analysts often progress to managerial or director positions within the corporate sector, focusing on strategic planning, internal growth initiatives, and cross-functional leadership. Both paths offer opportunities to transition into executive roles like Chief Strategy Officer or CFO, depending on expertise in deal-making or broader corporate strategy.

Compensation and Benefits Overview

Mergers & Acquisitions Analysts typically earn competitive base salaries ranging from $80,000 to $120,000 annually, often supplemented by performance bonuses and stock options tied to deal success. Corporate Development Analysts generally receive base salaries between $70,000 and $110,000, with a compensation structure that includes bonuses linked to strategic growth milestones and long-term incentive plans. Both roles offer benefits like health insurance, retirement plans, and professional development opportunities, with M&A positions often providing higher variable pay due to the transactional nature of the work.

Key Tools and Technologies Used

Mergers & Acquisitions Analysts primarily use financial modeling software like Excel and valuation tools such as Bloomberg Terminal and Capital IQ to conduct due diligence and assess deal viability. Corporate Development Analysts rely on CRM systems like Salesforce and enterprise resource planning (ERP) software alongside financial analysis platforms to support strategic planning and internal growth initiatives. Both roles utilize advanced data analytics and visualization tools including Tableau and Power BI for comprehensive market analysis and decision-making.

Impact on Organizational Growth and Strategy

Mergers & Acquisitions Analysts drive organizational growth by identifying and executing strategic deals that enhance market positioning and expand competitive advantages. Corporate Development Analysts focus on long-term strategic planning, assessing internal capabilities and market opportunities to align acquisitions with overall corporate objectives. Both roles are critical in shaping growth trajectories, with M&A Analysts emphasizing transaction execution and Corporate Development Analysts prioritizing strategic integration and value creation.

Choosing the Right Career: M&A vs Corporate Development Analyst

Mergers & Acquisitions Analysts specialize in deal execution, financial modeling, and market analysis to evaluate potential acquisitions or mergers, typically within investment banks or advisory firms. Corporate Development Analysts focus on strategic growth initiatives, including internal collaborations, long-term planning, and integration processes, primarily within a company's internal finance team. Choosing between these careers depends on whether you prefer fast-paced deal-making with external clients or driving corporate strategy through long-term internal projects.

Mergers & Acquisitions Analyst vs Corporate Development Analyst Infographic

jobdiv.com

jobdiv.com